Understanding Unconventional Resource Gas/Oil Plays

Unlike conventional reservoirs, low permeability unconventional resource plays are self-sourced and contain abundant seals. However, not all resource plays are created equal. Some are, or will be, commercial successes, and some will not. Even within the current commercially successful resource plays, there are both economic geologic sweet-spots and bypassed areas now being made commercial as a result of technological advances. iReservoir applies state-of-the-art and proprietary workflow elements of reservoir characterization and integrated production modeling to aid in the quantification of new resource plays and percentages that might be converted into future reserves.

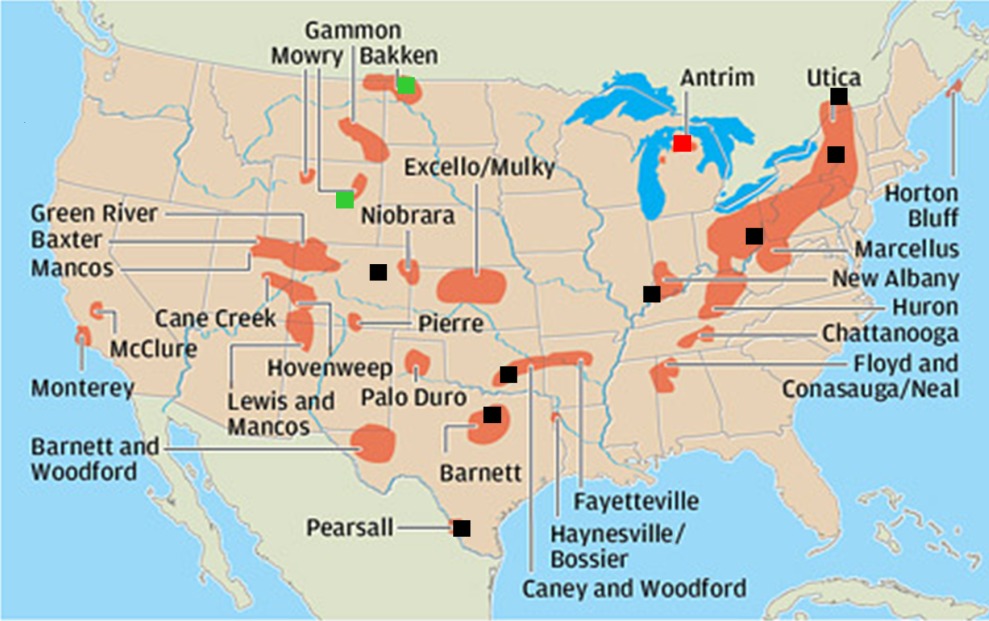

iReservoir has experience in a large number of resource plays in the United States. From this experience, iReservoir has gathered a substantial amount of data from reservoir characterization, drilling and completion designs, and historical production that have proved priceless for many scoping activities. New venture groups can use data such as TOC, Scf / Ton, “net-pay cutoffs,” estimated BHP, initial production tests, and rules-of-thumb that worked elsewhere to screen prospective new acreage for possible reserves. This screening approach may be sufficient to enter the play, but as drilling commences in new areas, iReservoir's characterization and production modeling approach can help evaluate the range of future reserve uncertainty and optimal well spacing.

iReservoir's Experience

in Resource Plays

Gas / rich liquids

|

Key questions for resource plays

- Are resources sufficient? How to identify pay and estimate initial saturations?

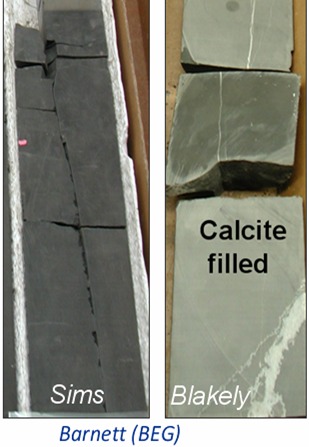

- Are geomechanical attributes favorable such that the rock can be “shattered”?

- Is the matrix permeability adequate so that matrix fluids can flow into shattered rock volume?

- Are fluid properties favorable for flow?

- Are reservoirs overpressured?

- Are natural fractures present in the rock?

iReservoir's approach to resource plays

- Geology: Depositional geo-controls for net pay, early analog selection, faults, fractures

- Geochemistry: Reservoir compartments, maturity uncertainty, gas-vs-oil ratios

- Petrophysics: Pay estimates, free and adsorbed gas, core-to-log calibration, SCAL interpretations (phi-k, Swi), logging choices

- Rock mechanics: Optimizing completions (treatment size, rates, number of stages, well orientation)

- Rock physics: Seismic calibrated sweet-spots, log scale brittleness (Young�s modulus and Poisson�s ratio)

- Seismic: Structure thickness, faults, sweet-spots, seismic scale brittleness, hazard avoidance, anisotropy

- Micro-seismic: Hydraulic fracture complexity, area of influence, height growth

- Reservoir Engineering: Fluid behavior, recovery estimates, well spacing and length, number of stages

- Drilling and Completions Engineering: Vertical vs horizontal, pilot holes, coring, casing design, completion design, hydraulic fracture design, sand and treatment volumes, fluid types

- Production Engineering: Long-term reservoir surveillance (pressures, water sampling, interference, calibration to micro-seismic events)

- Economics: Risk models, project-optimization

1. Quick screening

|

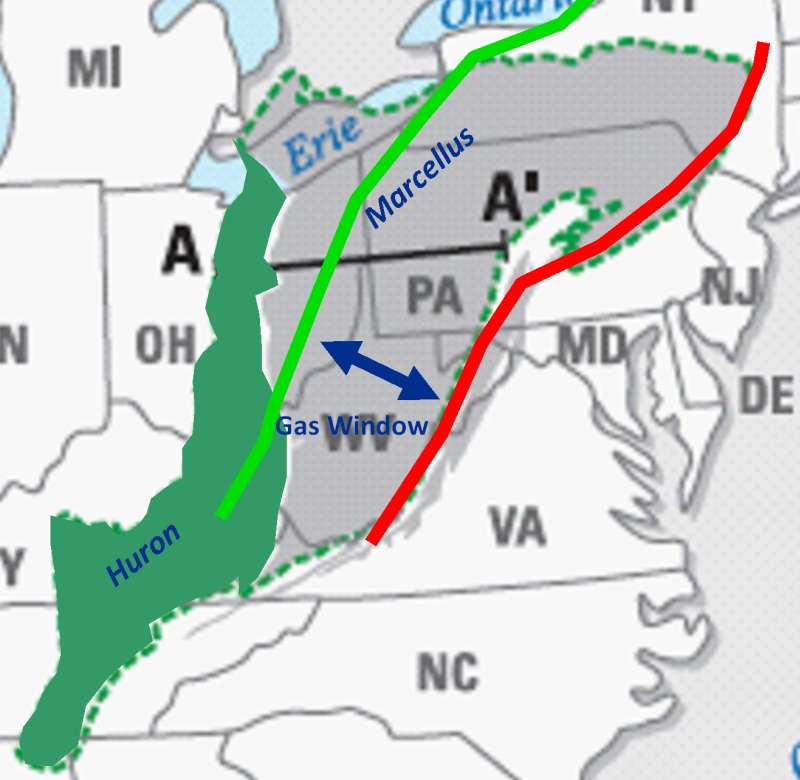

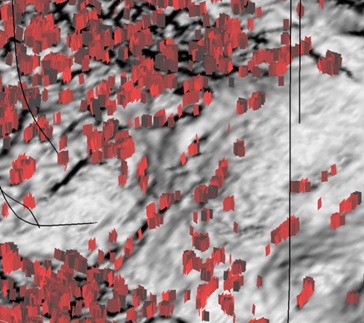

2. Play analyses/ High grading

“Water Resources and Natural Gas Production from the Marcellus Shale”, Daniel J. Soeder and William M. Kappel, USGS May 2009 |

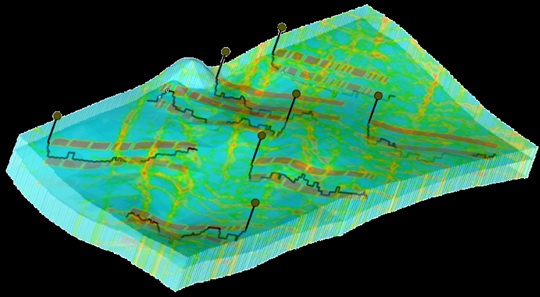

3. Natural fractures and brittleness from 3D seismic data

3. Natural fractures and brittleness from 3D seismic data

|

|

4. Flow simulation considering shattered rock and natural fractures

4. Flow simulation considering shattered rock and natural fractures

|